Context:

At the start of 2023, experts at the World Economic Forum warned that the global rise in public debt was a ‘fiscal ticking bomb’.

About Public Debt:

- It refers to the total amount of money that a government owes to external creditors and domestic lenders.

- It is the accumulation of borrowing by a government over time to cover budget deficits or finance various projects and programs.

- It measures the gross debt of the general government as a percentage of GDP.

- It is a key indicator for the sustainability of government finance.

- First, governments around the world unleashed fiscal stimuli to support their economies during the pandemic.

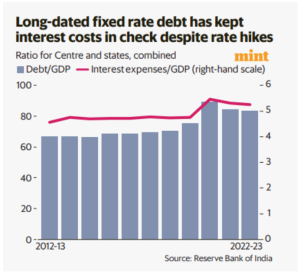

- Second, as the pandemic receded, a steep rise in interest rates increased the costs of servicing debt.

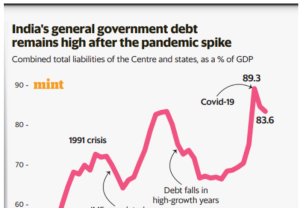

- India’s public debt is not expected to fall in the medium term, because budgetary revenues are unlikely to meet its growing funding needs, thus ensuring that the government will remain a large and consistent borrower.

- Yet India’s debt is considered to be sustainable, meaning that it is expected to meet its current and future debt obligations without default.

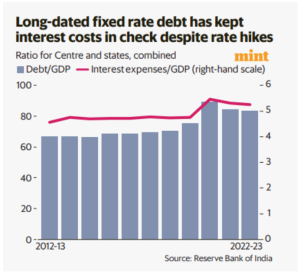

- India’s public debt is dominated by loans with long tenor and fixed-rate coupons.

- Public Debt is said to be sustainable if it increases at a stable or declining rate.

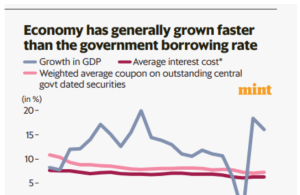

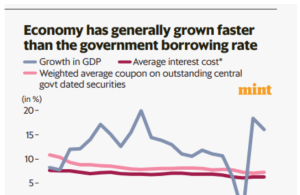

- India’s GDP growth has usually been higher than the government borrowing rate. The growth-interest differential remained positive even when rates went up in 2022. However, keeping a lid on primary deficit is much harder. The International Monetary Fund estimates India’s debt-stabilizing primary deficit at 2.3% of GDP, but the deficit was a whopping 4.6% in 2021-22.

Post Views: 215