Context:

Banks have written off bad loans worth ₹14.56 lakh crore in the last nine financial years starting 2014-15.

More on News

Current Status of Loan Write-off in India:

- Total Loan written off: ₹14.56 lakh crore

- Loans Written-off by Category (Large Industries and Services): ₹7,40,968 crore

- Recovery in Written-off Loans by Scheduled Commercial Bank (SCBs):

| Period | Recovery Amount (₹ crore) |

| April 2014 – March 2023 | ₹2,04,668 crore |

- Net write-off loans by public sector banks:

| Financial Year | Net Write off in crore |

| FY18 | 1.18 lac |

| FY22 | 0.91 lac |

| FY23 | 0.84 lac |

- Net write-off loans by private sector banks: ₹73,803 crore (RBI provisional data) in FY23

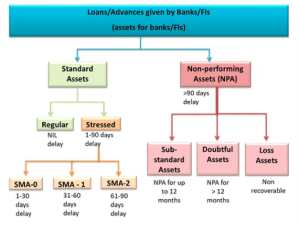

- Bad Loan: A bad loan is that which has not been ‘serviced’ for a certain period.

- Servicing a loan is paying back the interest and a small part of the principal — depending on the agreement between bank and borrower.

- Non-Performing Asset (NPA):

- All advances given by banks are termed “assets”, as they generate income for the bank by way of interest or installments.

- However, a loan turns bad if the interest or installment remains unpaid even after the due date.

- A loan becomes an NPA when the principal or interest payment remains overdue for 90 days.

- For agriculture, if principal and interest is not paid for two cropping seasons, the loan is classified as NPA.

- Classifications of NPA:

- Substandard Assets: Assets that have remained NPA for a period less than or equal to 12 months.

- Doubtful Assets: An asset remained in the substandard category for a period of 12 months.

- Loss Assets: An asset which is identified as a loss by the bank but not written off yet

- Additional Terms:

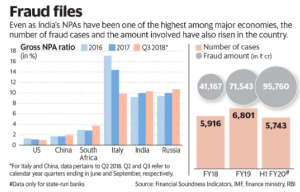

- Gross Non-Performing Assets (GNPA): It is the summation of all the loans that have defaulted by individuals from financial institutions.

- GNPA ratio is defined as a percentage of GNPA with total assets.

- Net Non-Performing Assets (NNPAs): It is calculated by subtracting provision for doubtful debt maintained by respective banks from GNPAs.

- The NNPAs ratio is defined as a percentage of NNPA with respect to total assets.

- Gross Non-Performing Assets (GNPA): It is the summation of all the loans that have defaulted by individuals from financial institutions.

- A loan write-off occurs when a lender removes a loan from its books, no longer considering it as an asset due to borrower default.

- Tax Liability Reduction: Writing off loans decreases the bank’s tax liability as the written-off amount is subtracted from profits.

- In financial year 2022, public sector banks in India reported a total of over 5.4 trillion Indian rupees in gross non-performing assets (NPA).

- This was a decrease from the 7.3 trillion Indian rupees in 2019.

- In contrast, private sector banks reported a decrease from two trillion Indian rupees to 1.8 trillion Indian rupees in financial year 2022 in gross NPAs.

- Economic Factors Leading to NPAs:

- Optimistic Economic Outlook: Many bad loans emerged during 2006-2008, a period of robust economic growth.

- This led to riskier lending decisions without proper due diligence.

- Global Economic Slowdown: Strong global growth pre-2008 Global Financial Crisis (GFC) was followed by a broader economic slowdown, affecting India too.

- Structural Economic Inefficiencies: Project delays, cost overruns, and regulatory processes create inefficiencies that contribute to NPA generation.

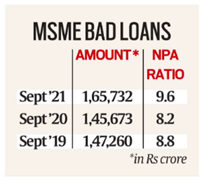

- Increased NPAs in MSMEs: Gross NPAs of MSMEs rose by Rs 20,000 crore to Rs 1,65,732 crore as of September 2021 from Rs 1,45,673 crore in September 2020.

- NPA under Pradhan Mantri MUDRA Yojana:

- The Micro Units Development & Refinance Agency (MUDRA) was launched on April 8, 2015 to provide loans up to Rs 10 lakh to non-corporate, non-farm, small and micro enterprises.

- Bad loans under the MUDRA Yojana for all banks is 3.38 per cent of the total disbursements.

- Optimistic Economic Outlook: Many bad loans emerged during 2006-2008, a period of robust economic growth.

- Structural Reasons:

- Lack of Identification: Lack of continuous monitoring in regulation resulted in evergreening loans instead of restructuring, delaying prompt action due to the inability to identify assets quickly.

- Loss of Interest from Promoters and Banks: When project delays depleted promoters’ equity, they lost interest. This led to project restructuring delay or banker abandonment, resulting in “zombie” projects.

- Weak Corporate Governance: Poor board quality with regard to due diligence, transparency, and accountability processes resulted in poor decision-making and ineffective credit utilization.

- Other Reasons:

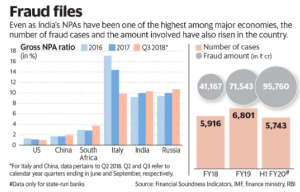

- Promoter Fraud: Fraud cases within public sector banks are on the rise, though smaller compared to overall NPAs. Lack of appropriate action against culprits might have led to fraudulent behavior.

- Manipulation of Restructuring: Before the Insolvency and Bankruptcy Code, promoters had significant influence on restructuring.

- Promoters could convert bank lending to equity, benefiting from gains while shifting losses to banks.

- Financial Performance: NPAs result in uncollected loan principal and interest, causing financial losses for banks. This affects their revenue and overall profitability.

- Capital Base: Banks need to set aside provisions for NPAs, eroding their capital base. This can challenge their ability to meet regulatory capital requirements.

- Liquidity Strain: Setting aside funds as provisions for NPAs affects banks’ liquidity, limiting their lending capacity and credit availability in the economy.

- The lack of liquidity prevents banks from lending and it may slow down the economy leading to unemployment, inflation, bear market, etc.

- High Interest Rate: To maintain their profit margins, banks will be forced to increase interest rates which again hurt the economy.

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002: It allows banks and financial institutions to seize collateral and sell them to recover dues without court intervention.

- Insolvency and Bankruptcy Code (IBC), 2016: It Offers a framework for time-bound resolution of stressed assets and supports creditors.

- Establishes National Company Law Tribunal (NCLT) and Insolvency and Bankruptcy Board of India (IBBI) to oversee the process.

- Bad Banks (2017): A bad bank separates risky and non-performing assets from a financial institution. It is also known as Asset Management Company (AMC).

- Former Interim Finance Minister introduced the idea of National ARC on the recommendation of the Sunil Mehta-led Committee.

- India’s first ever bad bank is National Asset Reconstruction Ltd (NARC). It purchases bad loans from banks, and sells them to distressed debt buyers.

- It is majorly controlled by PSBs, to acquire stressed loan assets above Rs 500 crore each amounting to about Rs 2 lakh crore in phases.

- India Debt Resolution Company Ltd (IDRCL) as an ARC sells stressed assets in the market.

- Prompt Corrective Action Framework:

- RBI launched PCA in 2002 for early intervention in struggling banks.

- Aim: To monitor and assist banks facing undercapitalization due to poor asset quality or loss of profitability.

- 2017 Review: The framework was reassessed in 2017 based on recommendations from the Financial Stability and Development Council and the Financial Sector Legislative Reforms Commission.

- Parameters include:

- Capital to Risk Weighted Assets Ratio (CRAR)

- Net Non-Performing Assets (NPA)

- Return on Assets (RoA)

- Gross NPAs of PSBs have declined to ₹4.28 lakh crore as on March 31, 2023 from ₹8.96 lakh crore as on March 31, 2018.

- Time-Bound Resolution: Introduce a sunset clause for resolution through Bad Banks to ensure timely action.

- Asset Maintenance: Establish a suitable mechanism within Bad Banks to fund the maintenance of asset quality during the resolution process.

- Strengthened Resolution Oversight: Set up more panels similar to the one by Indian Banks’ Association (IBA) to oversee resolution plans.

- IBA has set up a six-member panel to oversee resolution plans of lead lenders.

- Swift Recapitalization: Infuse additional capital into banks in a single installment to expedite recapitalization.

- Transparency: Continue transparent NPA recognition to maintain accurate data on bad loans.

- CIBIL Score: Utilize CIBIL scores to assess loan eligibility, ensuring responsible lending.

- Defaulters’ Information Circulation: Actively share information about defaulters to prevent them from obtaining further loans.

- Alternative Dispute Resolution Mechanisms: Promote the use of Debt Recovery Tribunals and Lok Adalats for quicker settlements.

Post Views: 158