The 182nd report on ‘Ecosystem of Startups to benefit India’ was tabled by the Department Related Parliamentary Standing Committee on Commerce.

More on News:

Overview of India’s Startup ecosystem:

Government Initiatives to strengthen the Startup ecosystem:

- Despite potential, only 5.18% of startups are agri-focused. Parliamentary Panel has raised concerns and calls to push funding & mentoring.

- Only 10,165, or 10.4%, of the 98,119 recognised start-ups have even applied for the tax sops.

- Just 1% of the more than 98,000 start-ups recognised by the Commerce and Industry Ministry have been able to avail Income Tax exemptions six years after the sop was announced.

- Financial assistance to the tune of Rs. 75.25 crore has been extended to nearly 1,176 agri-startups under the Rashtriya Krishi Vikas Yojana (RKVY) initiative, focusing on a spectrum of domains including precision agriculture, agro-processing, post-harvest technologies, and more.

- In India, A startup is defined as an entity that is headquartered in India, which was opened less than 10 years ago, and has an annual turnover less than ₹100 crore.

- It is typically characterized by its innovative ideas, products, or services.

- Startups often rely on a combination of personal savings, crowdfunding, angel investors, and venture capital to finance their growth.

- They are typically funded through bootstrapping, venture capital, or other means.

|

- As per the Startup Ecosystem Report 2023, In 2021, India minted a record 36 unicorns while raising a total of $72 billion in exits.

- In 2022, the number of unicorns was down 33 per cent to 24, and exits declined to $5.5 billion.

- The Indian startup ecosystem is ranked 20th in the world according to the Global Startup Ecosystem Index ranking (Startup Genome, 2021)

- Three Indian cities feature in the top 20 city ecosystems of the world— Bengaluru (10th), New Delhi (14th), and Mumbai (16th).

- In terms of the number of unicorns (startups with a valuation of $1 billion or more) produced, India is the third-largest startup ecosystem in the world behind China and the United States (US) (Sarkar, 2021).

- Unicorns: Start-ups founded after the year 2000 with a valuation of USD 1 billion.

- India has the 3rd largest startup ecosystem in the world; expected to witness YoY growth of a consistent annual growth of 12-15%.

- India has about 50,000 startups in India in 2018; around 8,900 – 9,300 of these are technology led startups 1300 new tech startups were born in 2019 alone implying there are 2-3 tech startups born every day.

- Employment Creation: India has 112 million working-age people between the ages of 20 and 24, compared to China’s 94 million.

- In the absence of government jobs, this demographic dividend is accelerating the country’s startup culture.

- New Investments: Not only Indian venture capitalists but also many multinational corporations are closely monitoring the progress of Indian start-ups to invest their money.

- For example: Accenture gave 1.35 million dollars worth of business to startups within the last year, giving startups an opportunity to make a significant impact on both the Indian and global markets.

- Research and Development: Start-ups heavily subsidize Research and Development (R&D) in countries like India as they frequently have to deal with high-tech and knowledge-based services.

- Democratizing the Technology Benefits: Fintech startups are now reaching out to remote areas with their solutions and making financial solutions easily accessible in tier 2 and tier 3 cities.

- For Example: Hesa, a Fintech and Agritech startup is one solution for all rural problems by bridging the rural-urban divide with technology and labor.

| Pros | Cons |

|

|

|

|

|

|

- “Startup India”: It was launched in 2016 which intends to catalyze the startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship.

- Faster Exit for Startups: The Government has notified Startups as ‘fast track firms’ enabling them to wind up operations within 90 days vis-a-vis 180 days for other companies.

- Startup India Hub: It is one of its kind online platforms for all stakeholders of the entrepreneurial ecosystem in India to discover, connect and engage with each other.

- Startup India Seed Fund Scheme (SISFS): The Scheme aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization.

- Credit Guarantee Scheme for Startups (CGSS): CGSS is aimed at providing credit guarantee up to a specified limit against loans extended by Member Institutions (MIs) to finance eligible borrowers viz. DPIIT recognised startups.

- Support for Intellectual Property Protection: The Government launched Start-ups Intellectual Property Protection (SIPP) which facilitates the startups to file applications for patents, designs and trademarks through registered facilitators in appropriate IP offices by paying only the statutory fees.

- States’ Startup Ranking: The States’ Startup Ranking is a yearly capacity building exercise created and released by Department for Promotion of Industry and Internal Trade (DPIIT) that evaluates all of India’s states and UTs on their efforts to build an ecosystem conducive to startup growth.

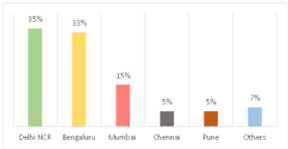

- Heavily Concentrated Funding: The three clusters Bengaluru, Delhi NCR, and Mumbai accounted for 92% of all the funds raised between 2018 and 2020, 1% higher than their share in 2015–18.

- Lack of Women Participation: The lack of representation of women in venture capital firms is also a reality in India. For Example:

- Only three of the top 20 Indian venture capital firms had a woman partner as of February 2020 (Dalal & Sriram, 2020).

- As per a recent report by Innoven Capital, less than 50% of the surveyed startups had more than 10% women in leadership positions (InnoVen Capital India, 2020).

- Limited Geographical Spread: India has three main startup clusters—Bengaluru, Delhi National Capital Region (NCR), and Mumbai.

- For Example: As of 13 September 2021, India had 75 unicorns, 83% of which (62) were from these three clusters.

- Regulatory Hurdles: Complex and arachaic regulations can create obstacles for startups, making it difficult to navigate legal processes, compliance requirements, and approvals.

- Access to Funding: At times, securing adequate funding can be challenging for startups, especially those in early stages. Access to venture capital, angel investments, and other funding sources can be limited.

- Market Readiness: Startups need to understand local consumer behavior, preferences, and cultural nuances to succeed.

- Lack of Mentorship: Startups often lack experienced mentors who can provide guidance, insights, and connections to help navigate challenges and make informed decisions.

- Intellectual Property Protection: Intellectual property rights enforcement can be complex and time-consuming, which can discourage startups from investing in research and development.

- Focusing more on the ease of doing business; a lot has been done but more support is needed so that founders can concentrate on core business rather than the bureaucracy around it.

- Upgrading the R&D infrastructure and curriculums in education institutions to make students ready for the digital world.

- Strengthening the domestic financing ecosystem — banks, VCs, institutions, use of pension funds, etc.

- Allowing the listing of domestic companies overseas

- Reducing the compliance burden under domestic tax regulations, labour laws, corporate laws, etc.

Post Views: 276